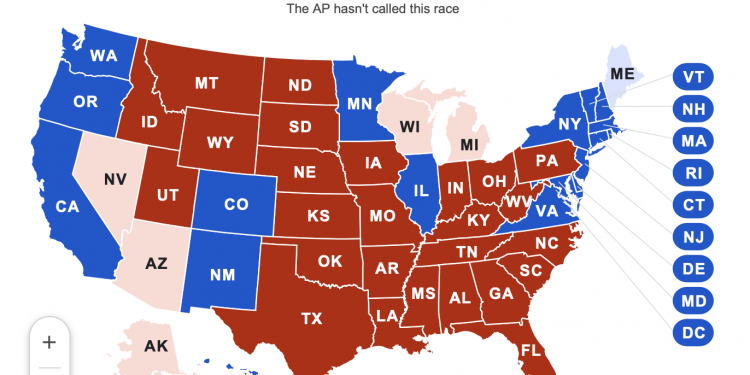

The 2024 Elections in the USA show that Trump leads in Michigan, Wisconsin, and Pennsylvania and has already been awarded 266 out of 270 votes necessary for the White House. Although the last votes were just counted, it looks like Trump’s route to the presidency is more probable.

Notwithstanding, Harris based their prediction mostly on their strongholds, and this was right, as the voters’ attendance in Northwestern County of Michigan and Milwaukee County of Wisconsin was high.

Meanwhile, the Republican Party has taken control of the Senate by transferring a Democratic seat in West Virginia and snatching the unexpected victory in Ohio, where Bernie Moreno has beaten Democratic Senator Sherrod Brown.

Soon after the fact that Republicans became the majority in the Senate, the entire political course in the USA witnessed a momentous turn that set things straight. Though the vote counting is still underway, in addition to the Trump leadership besides the Senate switch, politics in this country are now completely different from what they were before.

Election in USA: US Stock Futures gain 1.3%

US stock futures showed a sharp rise as investors were watching the election results that showed Donald Trump leading over Kamala Harris in the 2024 US presidential race. The Associated Press announced that North Carolina had gone for Trump, which was the first big swing state win of the night. Just before midnight ET, futures on the NASDAQ 100 and S&P 500 jumped about 1.3%, with Dow Jones Industrial Average futures increasing by more than 1%. This increase came after a day of vibrant trade on the one hand, exhibiting the optimism of the markets in the face of the election affair on the other.

Another financial move was futures tied to the 10-year Treasury note amounting to 11 basis points, which rose up to 4.4%, thus reflecting investor confidence. Besides, Bitcoin and Dollar have attained a record high through the “Trump trade” boom of the night.

Tesla Soars 3% and Trump Media Surges 20%

Tesla (TSLA) shares climbed 3% after hours owing to a potential gain by Republicans and ensuing regulatory ease in the sector, per chances from Byers. Elon Musk, a firm Trump supporter, saw this as a good opportunity to buttress his argument that people with the same project President Trump (DJT) have in mind share in the winnings.

TSLA/USD 15-Minute Chart

DJT grew 20% as the executive has come out best in some of the opinion polls. DJT stock was so changeable that the trade even stopped a little bit during the day, yet it closed with a minimal loss of only 1%.

DJT/USD 15-Minute Chart

US Election Outcome: Global Markets on Edge

All over the globe, investors are now intently watching the US presidential election as the result might likely cause some seriously big things to happen around the world, mainly in Asia.

The world’s largest economy significantly influences this decision, and confidence fills the atmosphere as some Asian stock indices clearly signal the trade challenge. The Japanese Nikkei 225 gained the highest percentage of 2.6%, and the Australian ASX 200. It closed the market with 0.8%, thus indicating a likely strong US election performance.

Henceforward, the US dollar also increased as traders eagerly awaited alterations that wings into the entirety of international business.

In fact, the last part of the equation that might not be so clear so soon in the future is a given besides the problem that some key states have not announced their results yet, which could last for days. Consequently, the Shanghai Composite Index is barely holding and nevertheless, Hong Kong’s Hang Seng has sank by 2.5%. The elections in USA are important for Taiwan, a major producer of computer chips and the main technology in the world that supports the global economy.

Trump outshouts Republicans in Congress, but they each take their routes already through financial markets. Make sure to be on high alert when the results from the US election come up!

The post Elections in USA: Trump Leads as Markets Surge appeared first on FinanceBrokerage.