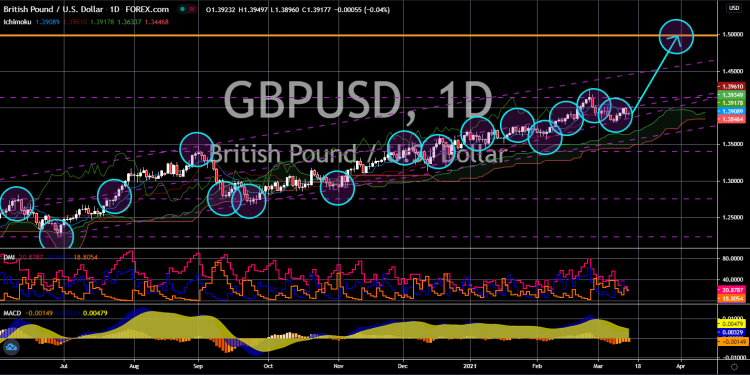

GBP/USD Drops to 1.2640, USD Finds Footing

Quick Look

USD’s modest gain sees GBP/USD slide, trading around 1.2640 with attention on US Non-farm Payrolls and Fed speeches. US jobless claims rise unexpectedly, reaching a two-month high, while geopolitical tensions boost USD’s safe-haven appeal. The UK’s Construction PMI barely shifts, highlighting ongoing challenges in the construction sector amid worsening housing market conditions.The GBP/USD currency pair is experiencing a mild downturn, trading around 1.2640 as of early Friday in the Asian session. This movement comes against the backdrop of a modest resurgence of the USD, which has found some footing at 104.20 amidst a general atmosphere of caution in the market. The eyes of investors and market analysts are keenly set on the imminent release of the US Non-farm Payrolls data, a critical economic indicator, along with additional data points such as the Unemployment Rate and a series of speeches from Federal Reserve officials, including Musalem, Kugler, Barkin, and Bowman.

US Economic Indicators: GBP/USD

The economic landscape in the US has presented a mixed picture this week. Initial Jobless Claims have seen a notable rise, reaching a two-month peak. According to the Labor Department, the latest figures for the week ending March 30 show an increase of nine thousand in new unemployment claims, reaching a total of 221,000, compared to the preceding week’s 212,000. This increment defied the market’s expectations, which were pegged closer to 214,000. On a slightly more positive note, Continuing Claims dropped by 19,000 to 1.791 million for the week ending March 23. Following this assortment of data, the Greenback experienced a decline, slipping below the 104.00 mark, before paring some losses amid rising geopolitical tensions, particularly the growing fears of an Iranian assault on Israel. These developments have, in turn, stoked a flight to the safety of the USD.

UK’s Housing Woes and Market Sentiments

On the British front, upcoming economic indicators hold significant relevance for the GBP/USD pair. The Construction PMI is anticipated to show a marginal improvement, moving to 49.8 from 49.7, signalling a persistently challenging environment in the UK construction sector. Furthermore, the Housing Equity Withdrawal figures are expected to reflect a deepening issue in the housing market, projected to deteriorate to -£22.3 billion from -£21.8 billion. These indicators underscore the ongoing struggles within the UK’s housing sector, potentially influencing the sterling’s performance against the dollar.

Upcoming US Data and Global Market Impacts

The forthcoming US economic releases are critical. They impact global markets, including the GBP/USD currency pair. Firstly, the Average Hourly Earnings are noteworthy. They should rise to 0.3% from the previous 0.1%. This increase indicates potential inflationary pressures.

Additionally, the Non-Farm Employment Change forecast deserves attention. Analysts predict it to moderate to 212K, down from a robust 275K. Concurrently, the Unemployment Rate should remain stable at 3.9%. Consequently, these indicators will illuminate the current state of the US economy. Finally, they will play a significant role in shaping the Federal Reserve’s policy decisions moving forward.

Market participants remain vigilant as the GBP/USD pair navigates through the fluctuations driven by these economic indicators and geopolitical concerns. The interplay of data releases and speeches by Fed officials will undoubtedly be crucial in shaping the trajectory of this major currency pair in the short term. Investors and traders alike should stay attuned to these developments, as they hold significant implications for currency valuations and market dynamics.

The post GBP/USD Drops to 1.2640, USD Finds Footing appeared first on FinanceBrokerage.